Imagine you are terminally ill, downsizing from house to apartment, or transitioning into a long-term care facility and you have personal possessions that you wish to distribute to family and friends. How do you decide who gets what and how do you prevent misunderstandings or hurt feelings among your loved ones? Personal property aka, non-titled property, is a catch-all phrase for any items that are NOT real estate or money which would typically be included in your will or trust. Items can include jewelry, clothing, household goods (such as a yellow pie plate), paintings, photographs, collections, such as postage stamps or model trains, antiques cars, and certain financial assets such as stocks and bonds that do not have a Transfer on Death clause. In many families, some are nostalgic items holding warm fuzzy memories wrapped around the user and their use. It is not necessarily the value of an item that makes it coveted by a family member, it’s more about the sentiment associated with it. “It’s often the emotional value attached to personal belongings that make transfers challenging.” Even in the most congenial families, problems can erupt when family members fight about who gets what.

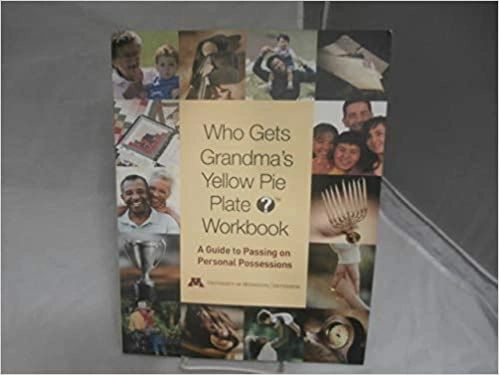

In 1999, the University of Minnesota developed a workbook/guide around the passing of personal possessions called, “Who Gets Grandma’s Yellow Pie Plate?” Granddaughter, Andrea, said the yellow pie plate was her great-grandmother’s and was passed down to her grandmother, then to her mother who had warm memories of making many pies. Many family holidays were celebrated around pies made in this special pie plate. Andrea said, “I hope that someday this yellow pie plate will be mine. It’s not just a piece of my past, it’s a piece of living history.” The workbook helps determine who gets what based on final wishes, fairness, and the desire to celebrate the person’s life and legacies while maintaining peace and harmony.

One good strategy is to have conversations around the issue before the person passes or moves rather than waiting until heirs are left with the task of cleaning out the house. Some people may assume their “stuff” is not worth anything while others don’t want to be caught in an emotional tug-of-war over “things.” It can get further complicated when there are many generations involved or when friends, rather than heirs, are the intended recipients. Issues emerge such as does a 20 something granddaughter have the same memories attached to an object as a 50-year-old daughter? What is fair and equitable in the distribution? It can also be complex when there are blended families, divorces and remarriages. Recognizing the sensitive nature of the issue is required in order to have a productive discussion. “There can be powerful messages in who gets what. Planning ahead allows for more choices, the opportunity for communication, and fewer misunderstandings and conflicts.” It is far better to decide ahead of time than to try and decide in the moment when there is a crisis, and where decisions may fail to reflect the owner’s wishes.

The workbook is full of ideas on various methods of distribution, fair ways to achieve it, and things to consider when one method is chosen over another. The list includes: gifting, someday promises (“after I die, you get my diamond tiara”), labeling items, private or silent auction with only the parties bidding, and, finally, family distributions where each item or group of items is discussed and then selection order is decided by a roll of the dice, drawing straws or numbers, birth order, gender, or generational preference. Whatever method the testator or heirs use to decide distribution of personal property, there should be ground rules and methods to resolve any conflict. Maintaining harmony in the group is the best way to honor their loved one and to avoid dissension in the family.

In my state, the Arizona, Sec 14-2513 references the distribution of tangible personal property. The testator can provide evidence of the intended distribution, in their own handwriting or by signing a writing describing the items to be distributed and devisees (recipients) with reasonable certainty. When deciding a case, the court relies on the intent of the testator and this writing would go a long way in proving testator intent. As always, consult with an attorney for guidance as every state has their own rules around the subject.